Dubai is not just a city of luxury and skyscrapers—it has transformed into a global business hub attracting thousands of entrepreneurs each year. With its investor-friendly policies, tax advantages, and cutting-edge infrastructure, Dubai offers a fertile ground for startups and SMEs looking to establish themselves in the Middle East and beyond.

If you’re considering business setup in Dubai, this guide will walk you through the entire journey—from choosing the right setup type to understanding costs, legal requirements, and expert tips for long-term success.

Why Choose Dubai for Business Setup?

| Feature | Benefit |

| 🌍 Strategic Location | Connects Asia, Africa, and Europe via world-class ports and airports |

| 💰 Tax-Free Environment | 0% personal income tax, 100% profit repatriation in many free zones |

| 🏢 Modern Infrastructure | Smart offices, digital connectivity, AI & blockchain investments |

| 📈 SME & Startup Support | Dubai SME, Expo legacy, innovation grants, and incubators |

Business Setup Options in Dubai

| Setup Type | Ownership | Trade Scope | Ideal For |

| Mainland | Up to 100% (sector-dependent) | UAE-wide | Local service providers, retail |

| Free Zone | 100% | International & zone-limited | Tech startups, exporters |

| Offshore | 100% | No UAE operations | Asset holding, global trading |

1. Mainland Business Setup

A Dubai mainland business setup allows companies to operate anywhere in the UAE. While you’ll need a local sponsor (holding 51% in some cases), recent reforms allow for 100% foreign ownership in many sectors.

2. Free Zone Business Setup

A Dubai free zone company setup is ideal for businesses that want 100% ownership, easy repatriation of profits, and simplified licensing. However, operations are usually limited to free zones and international trade.

3. Offshore Business Setup

This option is primarily suited for businesses that want to hold assets, manage wealth, or conduct international trade without having a physical presence in the UAE.

4. Key Differences & Best Option for SMEs

For startups aiming for local trade, mainland is the way to go. For exporters, tech startups, or e-commerce firms, free zones often provide better incentives.

Legal & Licensing Requirements

1. Trade License Types

| License Type | Activities Covered | Example Use Case |

| Commercial | Trading, import/export | Electronics trading |

| Professional | Services, consultancy, freelancing | IT consultancy |

| Industrial | Manufacturing, production | Food processing |

i. Commercial License – For companies involved in trading activities (e.g., import/export of electronics).

ii. Professional License – For service-based businesses like consultancy, IT services, or freelancing.

iii. Industrial License – For businesses engaged in manufacturing or industrial activities (e.g., producing food products).

Example: If you want to open an IT consultancy firm, you’ll need a Professional License. If your business imports mobile phones, you’ll need a Commercial License.

2. Documents Required

Common documents include:

1. Passport copies of owners/shareholders

2. Information about shareholders (ownership percentage, details)

3. Initial approval from authorities

MOA (Memorandum of Association), which outlines company objectives and ownership structure

Example: To register a trading company, you must submit passport copies of all shareholders and draft an MOA showing each partner’s ownership.

3. Government Approvals

Based on your business activity, extra approvals may be needed from specific authorities:

| Authority | Sector Examples |

| Dubai Municipality | Food, hospitality |

| DED | General trade, services |

| Sector Regulators | Health, education, finance |

1. Dubai Municipality (e.g., for food businesses, restaurants)

2. DED (Department of Economic Development) (general trade and service licenses)

3. Other regulatory bodies depending on the sector (like health, education, or finance).

Example: If you want to start a restaurant, you’ll need approvals from Dubai Municipality for food safety in addition to your trade license from the DED.

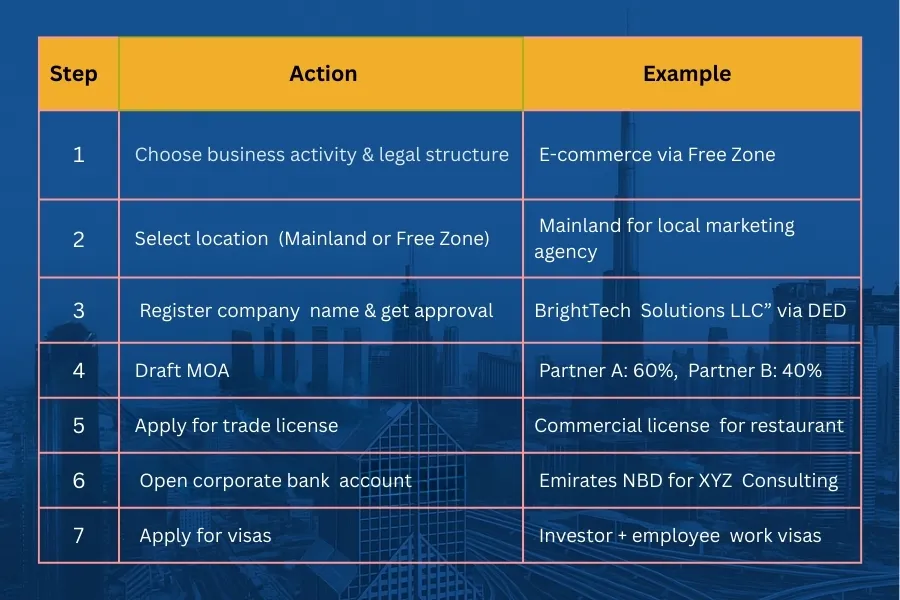

Setting Up a Business in Dubai – Step-by-Step Guide

1. Decide Business Activity & Legal Structure

Choose what type of business you want to run (trading, consulting, e-commerce, manufacturing, etc.) and the legal structure (LLC, sole proprietorship, branch office, etc.).

Example: If you want to sell clothes online, you’ll choose e-commerce activity with a free zone company structure.

2. Choose Location (Mainland or Free Zone)

Decide if you want to operate in mainland Dubai (can trade across UAE) or in a free zone (100% foreign ownership but limited to that zone and exports).

Example: A marketing agency targeting UAE clients should choose mainland, while an IT export business may benefit from a free zone like Dubai Internet City.

3. Register Company Name & Obtain Initial Approval

Pick a unique business name that follows UAE rules and get initial approval from the Department of Economic Development (DED) or free zone authority.

Example: Registering the name “BrightTech Solutions LLC” after approval from DED.

4. Draft MOA (Memorandum of Association)

Prepare the legal document stating ownership percentages, business activities, and responsibilities of shareholders.

Example: If two partners start a business, the MOA may state Partner A owns 60% and Partner B owns 40%.

5. Apply for Trade License

Submit your documents and MOA to get a trade license (commercial, professional, or industrial).

Example: A restaurant owner applies for a commercial trade license to legally run the business.

6. Open a Corporate Bank Account

Open a bank account in Dubai to handle company transactions. Some banks require office tenancy contracts and trade licenses.

Example: XYZ Consulting LLC opens an account with Emirates NBD for salary transfers and client payments.

7. Apply for Visas (Owners & Employees)

Apply for investor visas, work visas, or family visas under the company sponsorship.

Example: After setting up, the business owner applies for an investor visa and then sponsors two employees for work visas.

Costs of Business Setup in Dubai (AED)

| Expense Type | Mainland (AED) | Free Zone (AED) |

| Trade License | 10,000–15,000 | 8,000–12,000 |

| Office Space | 15,000–30,000 | 5,000–10,000 |

| Visa & Immigration | 3,000–7,000 | 2,500–6,000 |

| Annual Renewals | 5,000–10,000 | 3,000–8,000 |

Expert Tips for Startups & SMEs

- Choose the right free zone as according to your industry.

- Plan your budget and cash flow—don’t underestimate hidden expenses.

- Explore Dubai government initiatives supporting SMEs.

- Network through chambers of commerce trade events, and business councils.

- Hire a professional consultant to simplify the Dubai business registration process.

- Embrace digital marketing and e-commerce for rapid growth.

Benefits of Professional Business Setup Consultants

At PrimeCore UAE, we specialize in making your business journey in Dubai simple and stress-free. You can contact us to enjoy below advantages.

1. Save Time & Avoid Paperwork Hassles

We handle all documentation and government procedures on your behalf, so you can focus on growing your business instead of navigating complex paperwork.

2. Ensure Legal Compliance & Error-Free Documentation

Our team ensures that every step of your business setup meets UAE’s legal requirements, helping you avoid unnecessary delays or penalties.

3. Tailored Advice for SMEs & Startups

We understand the unique challenges startups face. That’s why we provide customized solutions designed to fit your industry, budget, and long-term goals.

4. Insider Knowledge of Free Zones & Industries

With years of expertise, we guide you in selecting the best free zone or mainland setup that perfectly matches your business activity and growth plans.

Why Hire PrimeCore UAE?

| Benefit | Description |

| 🕒 Save Time | We handle all paperwork and approvals |

| 📋 Legal Compliance | Avoid errors and penalties with expert guidance |

| 🎯 Tailored SME Advice | Customized solutions for your budget and goals |

| 🧠 Free Zone Expertise | Match your business with the right zone for growth |

Final Thought

Setting up a business in Dubai is one of the most rewarding moves for startups and SMEs. With strategic advantages, government support, and world-class infrastructure, Dubai is a hotspot for entrepreneurs worldwide.

If you’re ready to take the leap, start with a clear plan, explore the right setup option, and seek expert guidance when needed. The opportunities are endless—your entrepreneurial journey in Dubai can begin today!

FAQs

| Question | Answer |

| 1. ⏱️ Registration Time | 7–10 working days. |

| 2. 💰 Setup Cost for Small Business | AED 15,000–30,000 |

| 3. 🌍 100% Foreign Ownership Allowed? | Yes, in free zones and many mainland sectors. |

| 4. 🧑💼 Best License for Consultants/Freelancers | Professional License. |

| 5. 🧑💻 Why Hire a Consultant? | Saves time, ensures compliance, and boosts success. |